A high-profile case involving serious allegations of financial misconduct and fraudulent activities has recently gained significant attention. The Central Bureau of Investigation (CBI) has named several prominent individuals and entities in a detailed charge sheet, exposing a complex web of deceit and criminal conspiracy. The legal proceedings, marked by intense arguments, have brought to light a network of alleged fraudulent transactions that raise important questions about corporate accountability and legal integrity.

Case Background and Charges

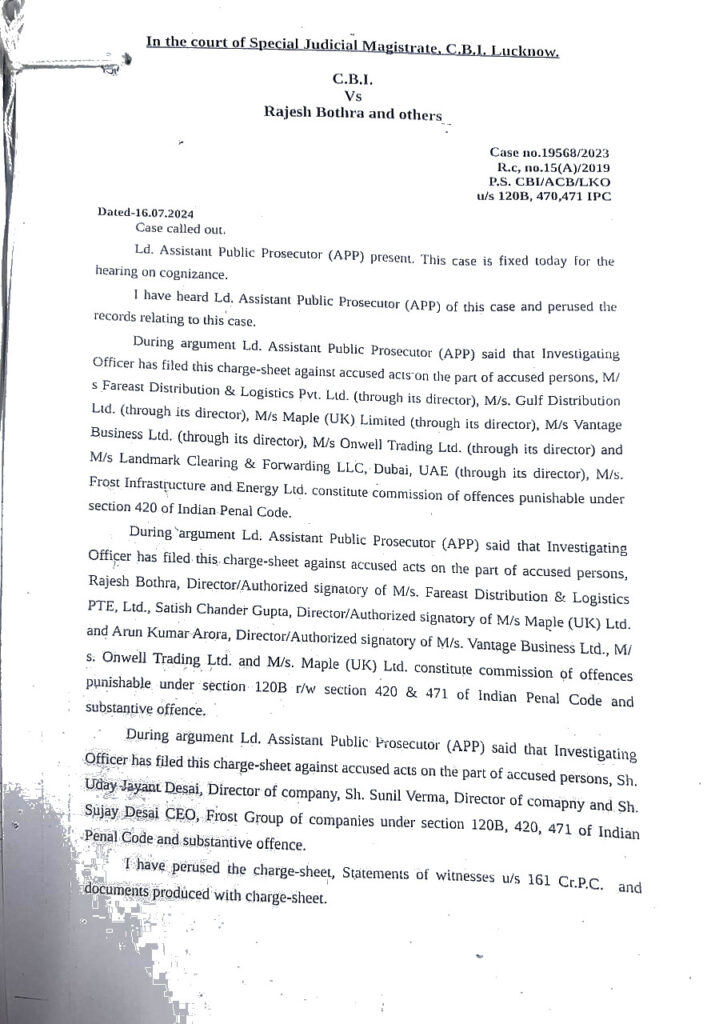

The case, officially titled “CBI vs. Rajesh Bothra and Others,” revolves around alleged criminal offenses under sections 120B (criminal conspiracy), 420 (cheating), and 471 (forgery) of the Indian Penal Code (IPC). Entities involved in the case include M/s Frost Infrastructure & Energy Ltd. from Kanpur, M/s Fareast Distribution & Logistics Pte. Ltd., M/s Gulf Distribution Ltd., and M/s Landmark Clearing & Forwarding LLC from Dubai. Individuals such as Shri Uday Jayant Desai, Shri Sunil Verma, Shri Sujay Desai, and Rajesh Bothra are accused of conspiring to commit fraudulent acts that resulted in substantial financial losses.

Role of the CBI and the Charge Sheet

The CBI’s Anti-Corruption Branch in Lucknow has been instrumental in investigating the case. The Investigating Officer, working under the CBI, has compiled a charge sheet that outlines the alleged criminal activities in detail. The prosecution argues that the accused entities and individuals orchestrated a conspiracy to commit fraud and forgery, leading to a breach of trust and monetary damages. The charge sheet is supported by witness statements under Section 161 of the Criminal Procedure Code (CrPC) and extensive documentary evidence, providing a solid foundation for the case.

Key Allegations and Evidence

During the hearing, the Assistant Public Prosecutor (APP) highlighted the gravity of the allegations. The APP argued that the actions of the accused violated Section 420 of the IPC, which deals with cheating and dishonestly inducing the delivery of property. In addition, charges under Section 471, concerning the use of forged documents, and Section 120B, related to criminal conspiracy, have also been levied against several accused.

The charge sheet further details the roles of specific individuals in facilitating fraudulent transactions. Corporate directors and key personnel are accused of orchestrating and executing these deceptive practices. The inclusion of international entities like Landmark Clearing & Forwarding LLC, Dubai, highlights the global scope of the alleged misconduct, suggesting that the fraud may have crossed borders.

Court’s Decision to Take Cognizance

After reviewing the charge sheet, witness statements, and supporting documents, the court has decided to take cognizance of the case. This marks a significant milestone, indicating that there is sufficient evidence to proceed with the trial. Cognizance has been taken under Section 420 of the IPC against the implicated corporate entities, and charges under Sections 120B, 420, and 471 have been accepted against individuals like Shri Uday Jayant Desai, Shri Sunil Verma, and Shri Sujay Desai. Additionally, Rajesh Bothra faces further charges under the same sections.

The court’s decision to take cognizance reflects the seriousness of the allegations and sets the stage for a formal legal process. It paves the way for the trial phase, where both the prosecution and defense will present their arguments.

Summons Issued and Next Steps

The court has issued summonses to all accused parties, requiring their appearance at the next hearing scheduled for August 17, 2024. During this hearing, copies of the charge sheet and related documents will be provided to the accused, formally beginning the trial. This development underscores the seriousness of the case, as the judicial system moves forward with a detailed examination of the charges.

Implications and Significance

This case highlights the essential role of investigative agencies like the CBI in uncovering complex financial crimes. The involvement of prominent individuals and international entities underscores the need for stricter corporate governance and accountability, particularly in the globalized business environment. As the trial progresses, the case is expected to set important precedents for handling corporate fraud and criminal conspiracy cases in the future.

The high-profile nature of the case has drawn significant public attention, as the outcome will determine the fate of the accused and send a message about the importance of maintaining ethical and legal standards in corporate conduct. This case is poised to have far-reaching implications, not just for those involved, but for the future of corporate governance in India. As the trial unfolds, the legal community and the public will closely watch, awaiting justice to prevail in this landmark case.